AI MARKETPLACES

maya.ai Marketplace Pilot

Launch an offers marketplace in 4 weeks. Boost activation rates, increase spend, and enhance customer loyalty with precision-targeted offers

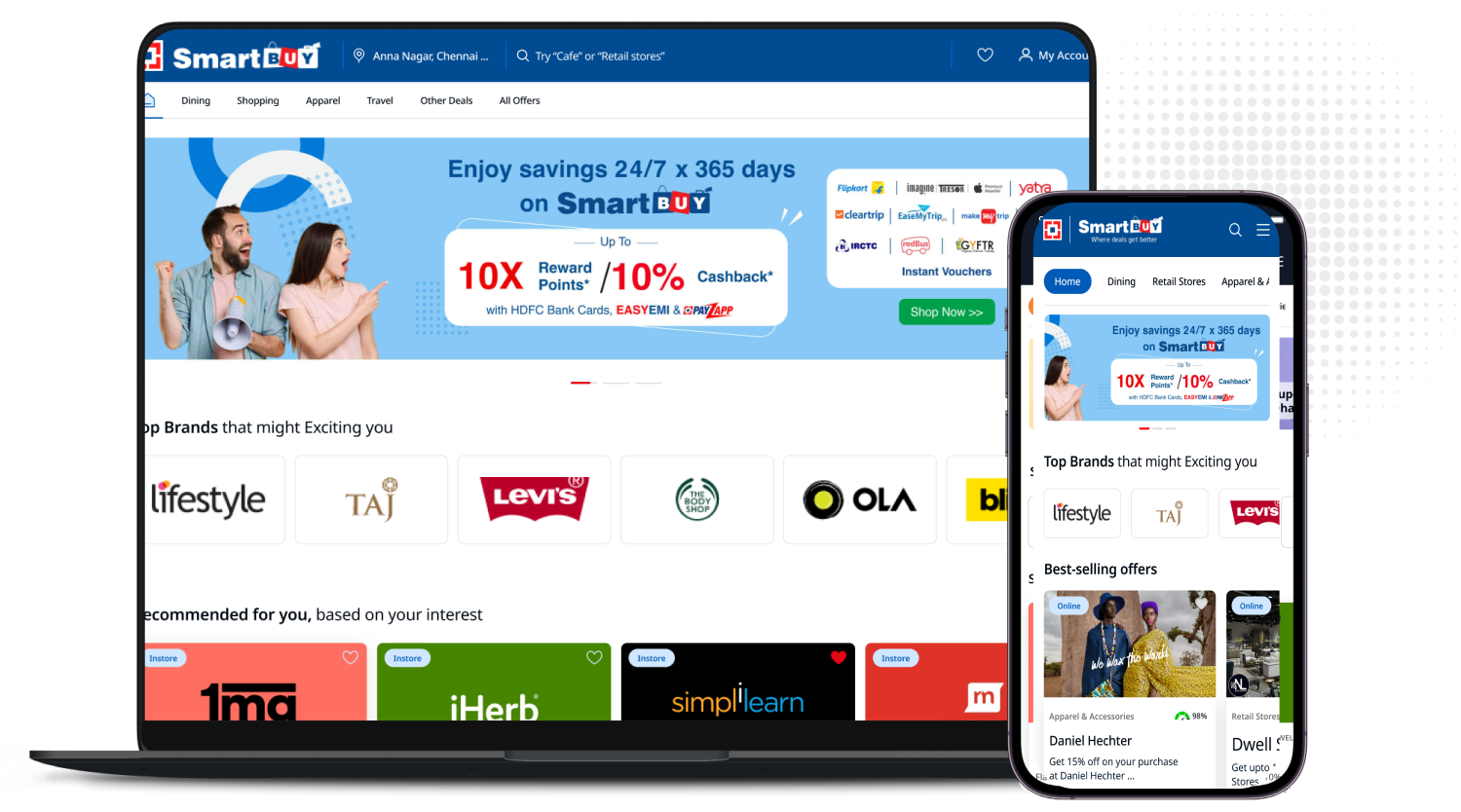

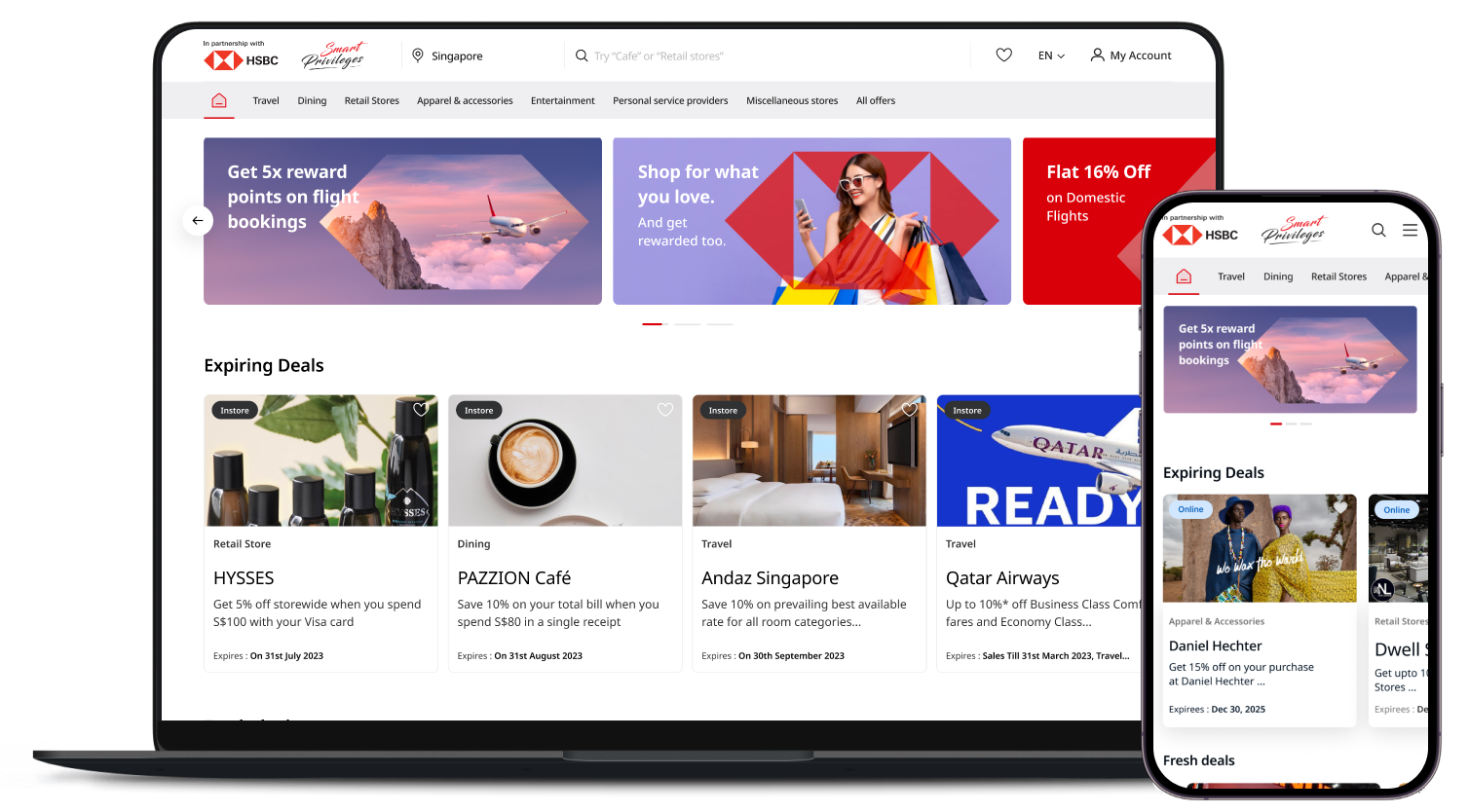

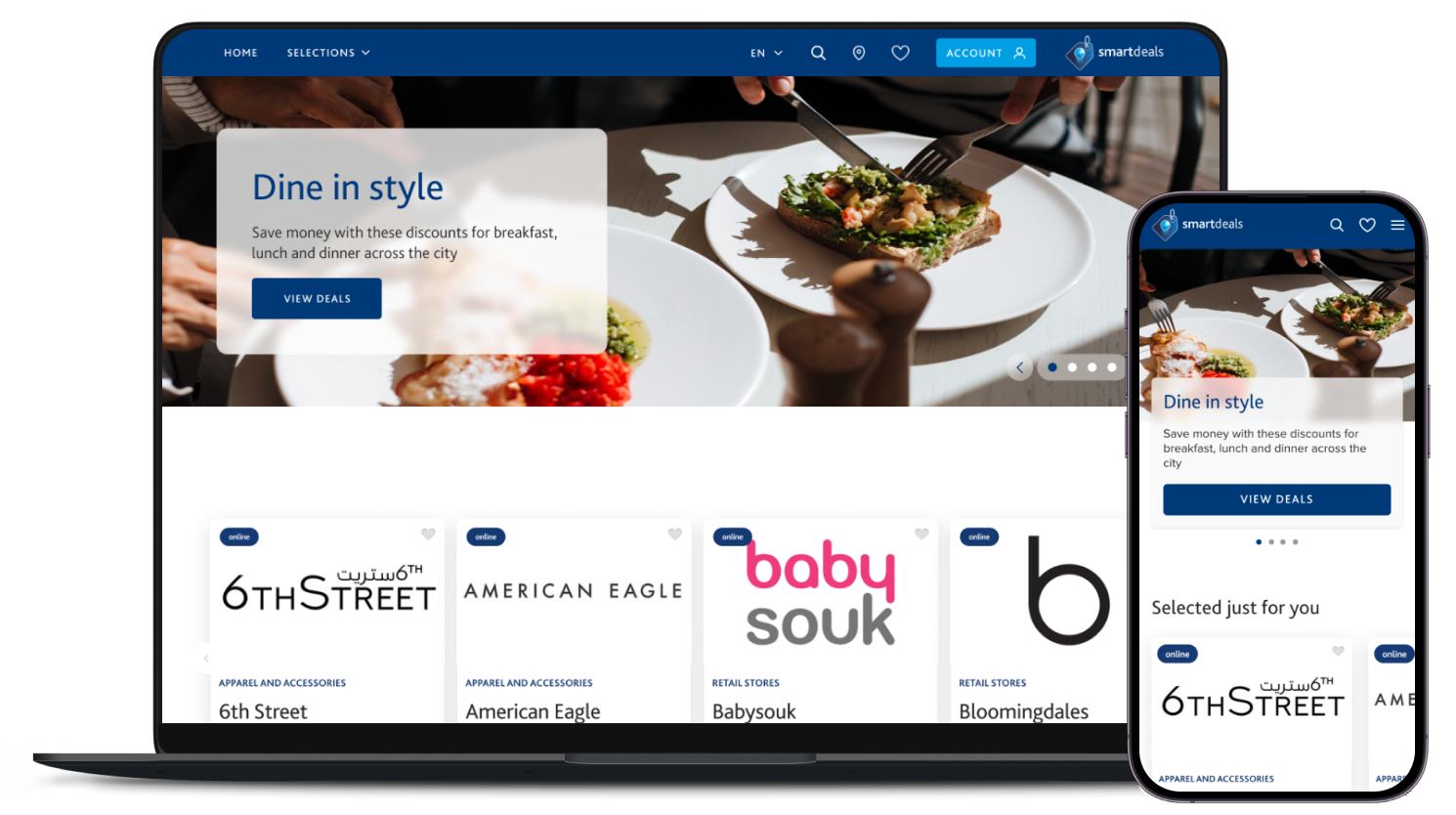

Give Your Customers an AI-Led Personalized Offers Marketplace

Intuitive, multilingual marketplace on white-label web app with pre-built offer packs and cold-start personalization.

User Experience: Seamless Engagement

Bilingual PWA: English & Arabic at your fingertips

Instant access: No login, one URL, any device

Smart onboarding: Taste Collection for tailored recommendations

Instant access: No login, one URL, any device

Smart onboarding: Taste Collection for tailored recommendations

Offer Sourcing: Diverse & Dynamic

Global reach: 50+ offers in UAE & Singapore via maya.ai

Bank’s existing offers: Inclusion of the bank's current offers in the marketplace.

Partner offers: Leverage offers from partners like Visa

Bank’s existing offers: Inclusion of the bank's current offers in the marketplace.

Partner offers: Leverage offers from partners like Visa

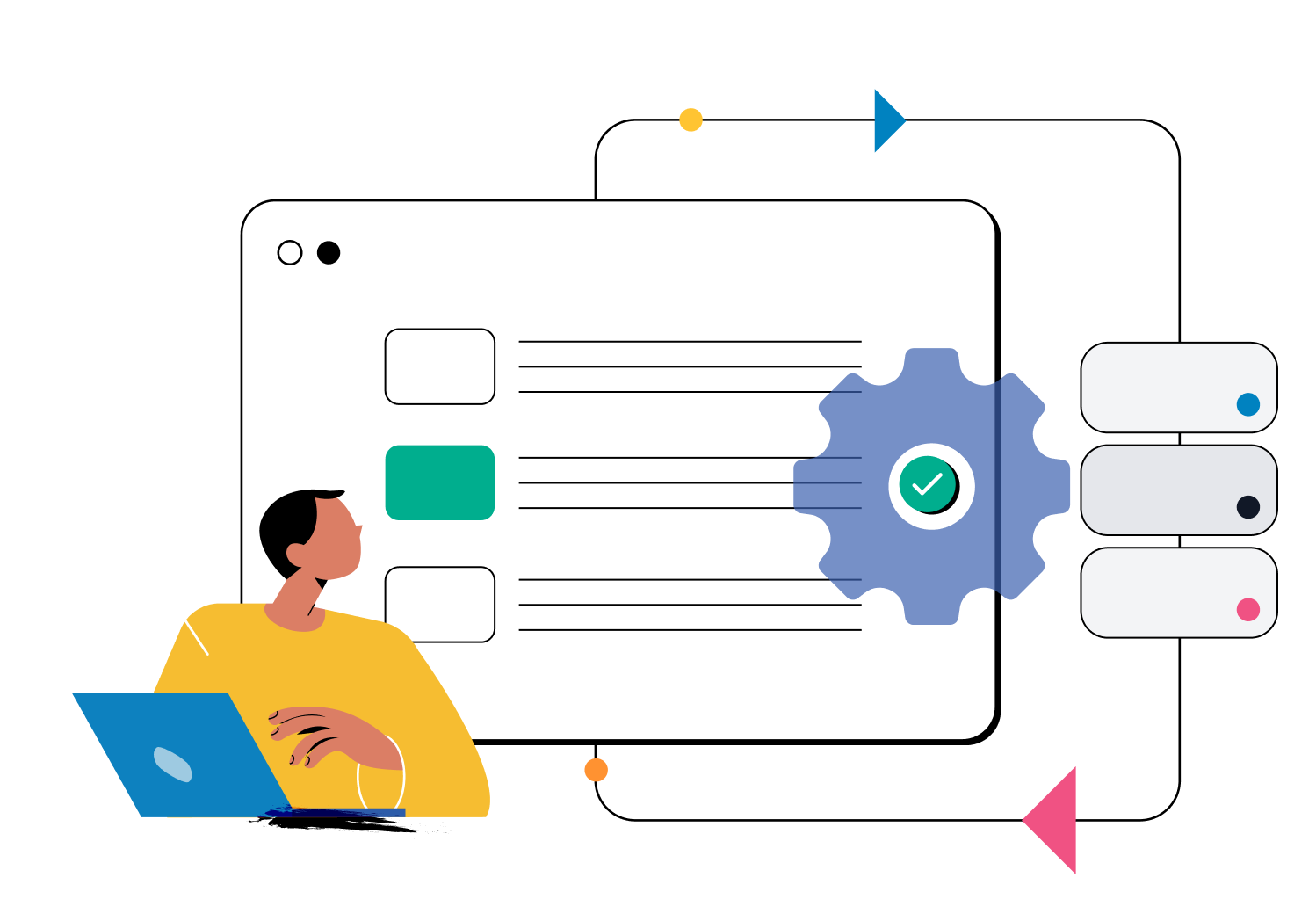

Offer Management: Total Control

Effortless updates: Add offers individually or in bulk

Full lifecycle: Enrich, review, publish, and track performance

One platform: Manage all offers with ease

Full lifecycle: Enrich, review, publish, and track performance

One platform: Manage all offers with ease

Personalization: AI-Driven Relevance

Digital data: User interactions and clickstream data

AI-led matching: Based on user behavior & context

Location-based: Domestic & international offer visibility

AI-led matching: Based on user behavior & context

Location-based: Domestic & international offer visibility

Launch Within 4 Weeks

Tailored rollout ensuring minimal disruption and maximum impact on your card portfolio

Week 1 - 2

Setup & Configuration

Onboard offers from Crayon Data, Bank, and partners.

White label the PWA and configure the personalization engine.

White label the PWA and configure the personalization engine.

Week 3 - 4

Test & Publish

Internal testing of the platform, including user onboarding and recommendation features.

Implementation of marketing banner on digital assets

Implementation of marketing banner on digital assets

Week 5 - 12

User Testing

User testing with selected cardholders in UAE and Singapore.

Collect feedback and data on user experience and engagement.

Collect feedback and data on user experience and engagement.

Week 13 - 16

Evaluation & Reporting

Analyse pilot results and present findings and recommendations

Track Key Engagement Metrics to Measure Impact

Monitor key metrics and adjust strategies on the fly

Given the short duration of Pilot, it will not be feasible to observe significant changes in customer spending. Instead, the focus will be on key engagement metrics to measure the impact of the platform. These metrics include:

View Rates

The ratio of content views to total visits

Viewer Rate

The proportion of visitors who actively engage with the content

Redemption Rate

The ratio of offer redemptions to views

Redeemer Rate

The proportion of users who redeem offers compared to those who view them

Pre vs. Post Campaigns Spike

he variation in view and redemption rates before and after specific campaign executions, depending on Bank’s implementation of suggested campaigns and notification of campaign dates for accurate analysis.

Session Time

The average duration of user sessions on the platform

Repeat Visitors

The number of users returning to the platform over the Pilot period

These engagement metrics will be benchmarked against the performance of Bank’s existing digital portal to assess relative improvements.

Measure Outcomes Aligned with Your Business Goals

Clear benchmarks for success, from increased customer engagement to heightened card usage

Demo

Functional demonstration of the offers marketplace platform.

Compliance

Compliance with relevant regulations and standards

Refine

Iterate, test, and refine your solution. Find your product-market-fit and unlock new synergies with the maya.ai suite

Tracking

Positive impact from user testing on user engagement metrics (e.g., offer views, clicks, redemptions)

No Data, Infrastructure or Tech Integration Needed

Our flexible cold start deployment ensures smooth implementation without needing any tech bandwidth for your enterprise.

Tech Team's Role

No Technical Integration Required

The Pilot will be executed without any technical integration with Bank’s systems

No Infrastructure Required

Solution will be hosted on private cloud instance managed by Crayon Data

No Data Required

The solution will not require access to any data from the bank

Marketing Team's Role

Provide Brand Guidelines

Logo usage and color palette

Share current offers

Offers sourced by current teams or partners

Publish Web App

The marketing team will publish the PWA to existing digital channels through a banner.

Drive Traffic

The marketing team will drive traffic to the PWA through regular campaigns.

Business SPOC's Role

Coordination

Coordinating efforts between Bank & Crayon Data

Pricing Model Aligned with Your Success

One-time setup fee and a monthly subscription fee

Inclusions

Offer Sourcing and Management

Ingest and clean bank's offer metadata & creatives

maya.ai Cross border merchant offers

VISA / Mastercard Offers

maya.ai Cross border merchant offers

VISA / Mastercard Offers

User Experience

White-labeled Progressive Web App (PWA)

Data Management

Ingest, process and enrich digital interaction data

AI-led Recommendations

Digital interaction-led recommendations

Learn More

Interested in a larger scope for your offers marketplace? Visit our pricing page to find the best fit for your needs and see how our packages can deliver the results you're looking for.