Unlocking the Personalization Promise: What Banks Must Deliver

December 1, 2023

AI Guardians of the Digital Wallet Galaxy

December 14, 2023The Crayon Blog

Fintech and payments trends to watch out for in 2024

| Published December 14, 2023 | Susanna Myrtle Lazarus

Payments as a market is undergoing massive changes

As customer preferences evolve, so are the technologies they use. Globally, there are a number of key drivers behind the changes we’re seeing today. According to the ‘Top 10 Fintech and Payments Trends 2024’ Report from Juniper Research, three factors are on top.

1. Cost-conscious consumers and businesses:

- Prices are rising, and people are watching their spending closely.

- Businesses need to save money too, so they want cheaper payment systems.

2. Reducing reliance on cards:

- Card payments are expensive for businesses, so they want new options.

- New payment methods like instant payments are gaining traction.

3. Standing out from the crowd:

- There are lots of payment options now, so it’s hard to be unique.

- Businesses need creative solutions to offer a better user experience.

To best address these, fintech and payment providers will have to scale back on innovation and focus on market fit. Enterprises and customers are looking for solutions that address their particular needs. They’re currently less interested in speculative gains. This is also exacerbated by the economic conditions: cost-saving solutions are the need of the hour. Now that we have a wider context, let’s look at some of the most impactful trends coming up in 2024 according to this report.

A2A payments to challenge cards in ecommerce and for funding wallets

In developed countries, digital wallets like Apple Pay and Google Pay are popular, but they still rely on traditional cards. This means they’re not truly independent payment methods. However, in other parts of the world, like India, Brazil, and China, Account-to-Account (A2A) payments directly between bank accounts are more common.

Here are why A2A payments are gaining traction:

Here are why A2A payments are gaining traction:

Open Banking: This allows apps to access bank accounts securely, making A2A payments easier. Open Banking is becoming increasingly popular, especially in the UK.

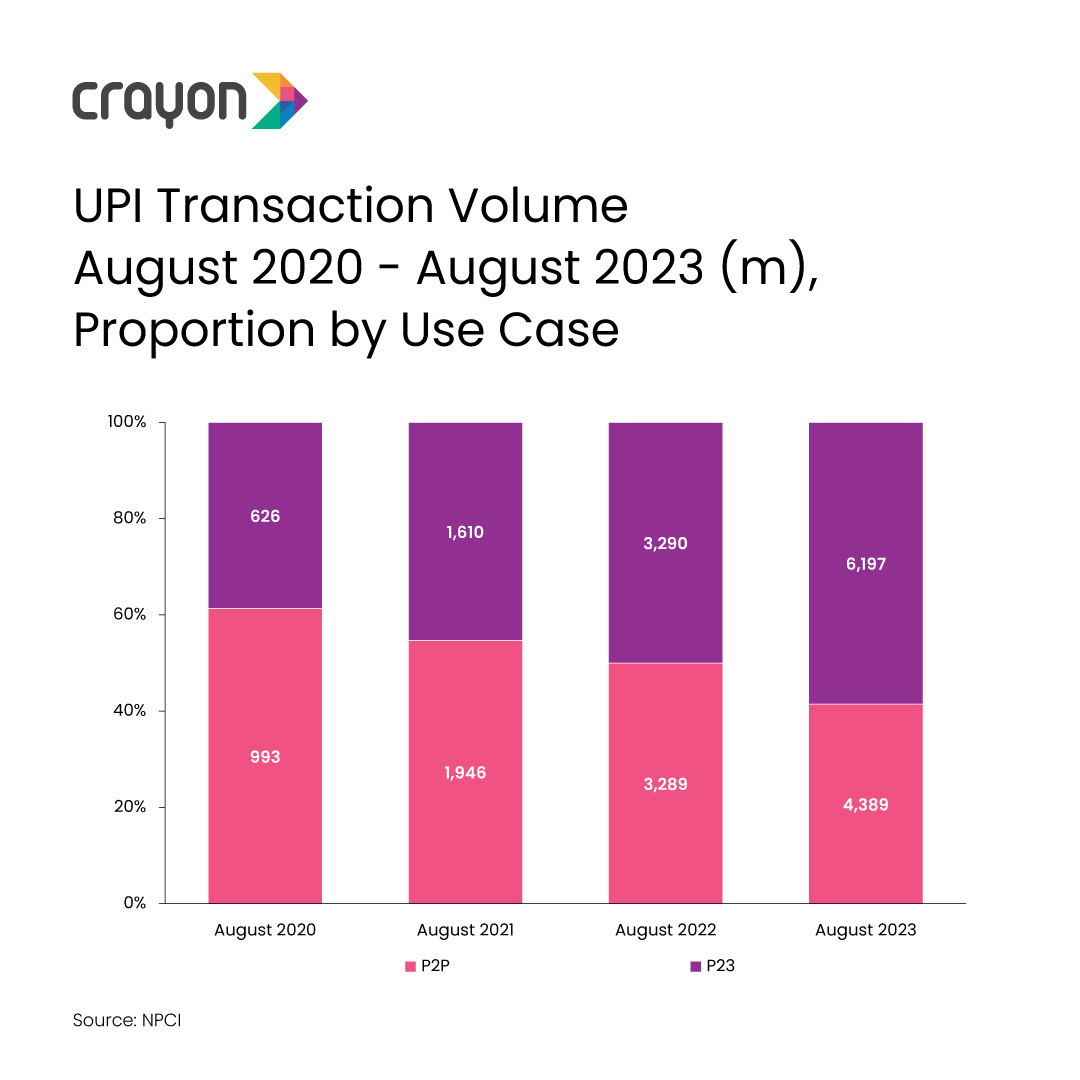

Instant Payment Systems: Fast and cheap instant payment systems like UPI in India are also growing rapidly. These systems are convenient alternatives to cards.

Shifting Trends: In some countries, people are even using instant payments for merchant transactions. This shows that A2A payments could become the dominant payment method in many markets.

Instant Payment Systems: Fast and cheap instant payment systems like UPI in India are also growing rapidly. These systems are convenient alternatives to cards.

Shifting Trends: In some countries, people are even using instant payments for merchant transactions. This shows that A2A payments could become the dominant payment method in many markets.

Merchants too are increasingly favoring A2A payments primarily for their cost-effectiveness, as the acceptance cost is notably lower than that of cards. Additionally, the speed of instant payments accelerates settlement times, allowing merchants quicker access to funds. Users opting for A2A payments via Open Banking benefit from added security, as verifications occur through their mobile banking apps, reducing fraud rates.

Generative AI in banking to transform spending insights

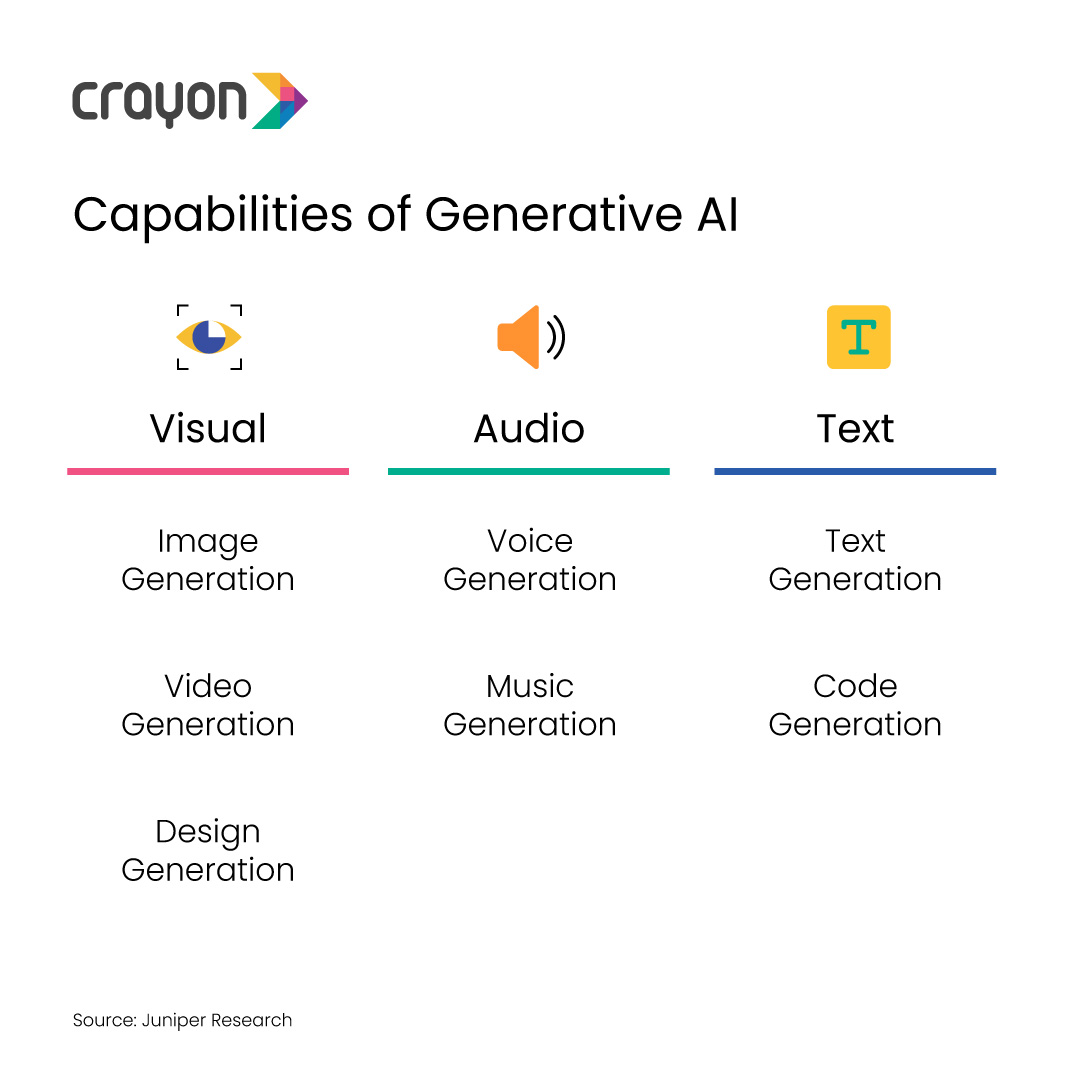

The banking sector holds immense potential for generative AI due to its vast reservoir of data, encompassing transaction behavior, account balances, and spend categories. This allows generative AI to create valuable content, enhancing customer relationships. Moreover, traditional banks face fierce competition from digital-only banking brands like N26, Monzo, and Revolut, which excel in providing compelling user experiences and insights into spending habits.

As banks vie for customer loyalty through superior user experiences, generative AI becomes a crucial solution for rapid improvements. In 2024, we anticipate a disruption in spending insights through generative AI deployment. While traditional spending analyses have been somewhat basic, generative AI introduces a robust recommendation engine. By analyzing data and offering personalized product recommendations, generative AI enhances the user experience, addressing the longstanding challenge of effective personalization in banking. Despite the evident benefits, banks are expected to approach generative AI cautiously, mindful of potential regulatory challenges in highly regulated sectors.

As banks vie for customer loyalty through superior user experiences, generative AI becomes a crucial solution for rapid improvements. In 2024, we anticipate a disruption in spending insights through generative AI deployment. While traditional spending analyses have been somewhat basic, generative AI introduces a robust recommendation engine. By analyzing data and offering personalized product recommendations, generative AI enhances the user experience, addressing the longstanding challenge of effective personalization in banking. Despite the evident benefits, banks are expected to approach generative AI cautiously, mindful of potential regulatory challenges in highly regulated sectors.

Sustainable fintech solutions to emerge, as ESG compliance tops agenda

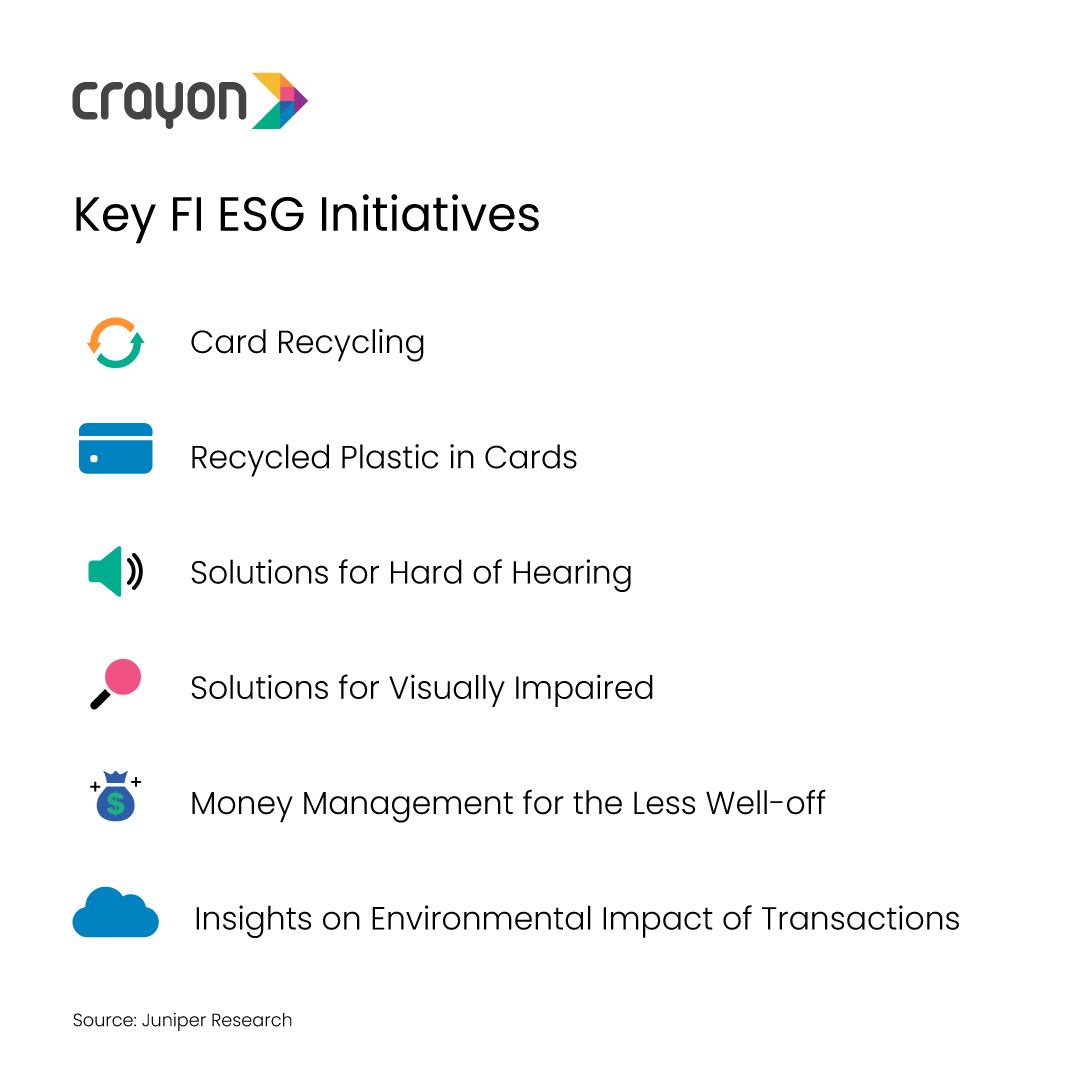

In 2023, environmental and social concerns took center stage, driven by the climate crisis and a widening cost-of-living gap. Financial institutions faced challenges navigating this landscape. Tech vendors responded with initiatives addressing ESG (Environmental, Social, and Governance) issues, as illustrated in recent developments. Technology-enabled solutions, like audio-based transaction confirmations for the visually impaired and Open Banking integration for environmental impact data, emerged.

While some tech, such as reduced-plastic cards and money management tools, is established, the novelty in 2024 lies in a cohesive approach. Leading financial institutions are expected to adopt coordinated ESG strategies as differentiators in the competitive and commoditized banking industry. Fintech sustainability initiatives are set to gain momentum in 2024, with technology providers developing scalable solutions, supported by the growth of Open Banking for enhanced data analysis. The effectiveness of these strategies in attracting customers remains uncertain, requiring banks to coordinate ESG efforts diligently.

While some tech, such as reduced-plastic cards and money management tools, is established, the novelty in 2024 lies in a cohesive approach. Leading financial institutions are expected to adopt coordinated ESG strategies as differentiators in the competitive and commoditized banking industry. Fintech sustainability initiatives are set to gain momentum in 2024, with technology providers developing scalable solutions, supported by the growth of Open Banking for enhanced data analysis. The effectiveness of these strategies in attracting customers remains uncertain, requiring banks to coordinate ESG efforts diligently.

Mobile financial services to accelerate transition to banking tech services

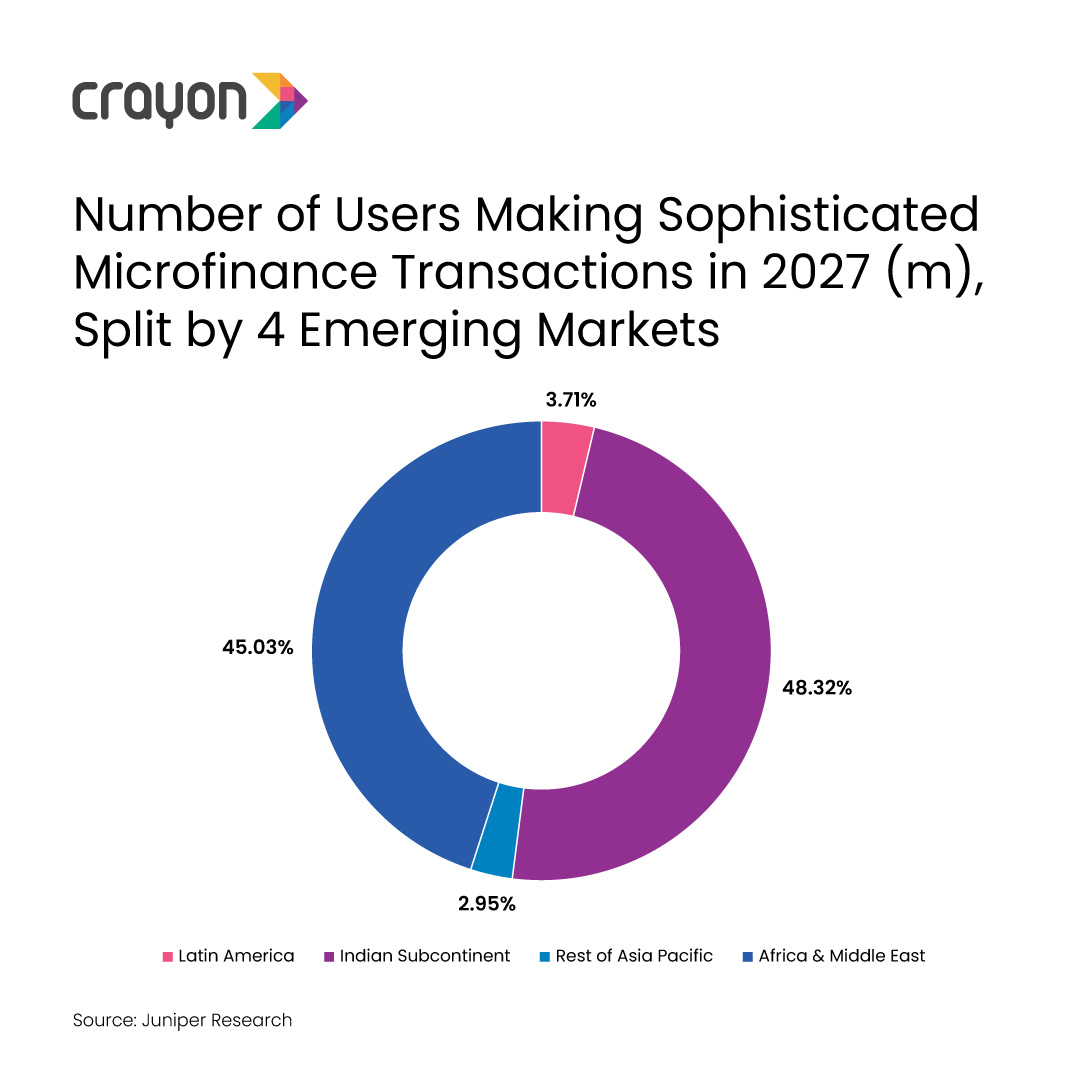

In the realm of disruptive trends in fintech and payments, mobile money services often don’t receive their due recognition. Over the past decade, mobile money has remarkably transformed payments in emerging markets, with platforms like M-PESA and MTN MoMo outpacing services in developed markets. However, 2024 marks a shift in focus from peer-to-peer transactions to more sophisticated, banking-like services.

This presents a crucial opportunity for Mobile Financial Services (MFS) providers, especially in regions where traditional banks face challenges. Leveraging wide agent networks, MFS providers possess unparalleled scale and reach compared to bank branches, enabling the delivery of localized services. Anticipated in 2024 is a transition for many MFS providers towards advanced services, utilizing the data they hold as Mobile Network Operators (MNOs) to offer tailored solutions. Partnerships with banks will likely be announced, allowing MFS providers to tap into additional services without direct competition, ushering in a new phase of growth for the sector.

This presents a crucial opportunity for Mobile Financial Services (MFS) providers, especially in regions where traditional banks face challenges. Leveraging wide agent networks, MFS providers possess unparalleled scale and reach compared to bank branches, enabling the delivery of localized services. Anticipated in 2024 is a transition for many MFS providers towards advanced services, utilizing the data they hold as Mobile Network Operators (MNOs) to offer tailored solutions. Partnerships with banks will likely be announced, allowing MFS providers to tap into additional services without direct competition, ushering in a new phase of growth for the sector.

These trends and more are setting the stage for a safe and calculated, yet evolving payments scene that fintechs will have to keep up with in 2024.

Recent Blogs

Subscribe to the Crayon Blog. Get the latest posts in your inbox!