Even as the first month of the year draws to an end, some of us are still cleansing our phones of the new year wishes and sale/offer messages. Meanwhile, the BFSI industry is thinking of ways to capitalize on the successes of the past year. Innovation worked wonders, as they saw a success rate of 65%. This is reflected in the trends that are picking up in 2023. And customers are at the heart of it all. Product offerings are just as important, but they play a supporting role in this show. Here are seven key trends that will affect the way the BFSI industry fares in 2023

1. Open Banking, Sesame!

Simply put, open banking is the process of sharing customers’ data with select apps (with the customer’s consent, of course). Budgeting apps that analyze expenditures and incomes based on the incoming SMS could be considered baby versions of this concept. Open banking has the potential to simplify finance for the customer.

A good example of this would be subscription management services like Subaio. This idea demonstrates that subscription management doesn’t have to be done on a separate platform. Banking apps like Nordea Wallet have started making it a part of their banking interface to give the customers the experience of a super-app. This platform also offers easy cancellation, should a customer feel that they no longer require a service. Subaio reports that their subscription management service has helped Nordea customers save almost 0.5 million euro, in just the first 3 months of the collaboration.

As competitive as the financial space is, many banks are yet to pounce on the hidden revenue stream of Loan Switching. Aggregation of financial data will help banks detect loans from competitors. Let’s say bank A sees that a customer has availed a loan from bank B. Bank A could seal the deal by personalizing the loan or by pooling several smaller loans into a single loan to optimize them.

However, like any other novelty, open banking too comes with its fair share of concerns. The prime of these being data security. It could open them up to hacking and security risks. Introducing multi-level verifications could be a weapon in tackling such breaches.

2. Unlock Data to Unlock the Future

Numerous financial enterprises have scaled up by unlocking the power of data and the stories they can tell.

The success story of CBA (Commercial Bank of Africa) is as inspiration to the entire BFSI sector. The bank partnered with a telecom operator to offer mobile lending and saving services. This effort to bring about financial inclusion was spearheaded by the launch of M-Shwari, the platform built in association with VeriPark. This fully digital service requires no signing of documents. Micro-lending and micro-saving were the focus areas. This effort brought about a massive increase in customer acquisition. The customer base grew from 50,000 to 22,000,000, i.e., a 440% growth!

Why does this story resonate so much? Africa is a nation in which m-commerce has found a larger audience than e-commerce. With such a mobile-focused audience, CBA thought that financial inclusion could be better achieved if banking was rendered on their mobiles. Thus, when actionable insights from internal data are coupled with relevant third-party data from external sources, the success is almost unstoppable.

3. A branch is a branch is a branch!

More innovations have stemmed from ‘Why not’, than from ‘Why’. Digital branches are one such step in taking banking to the next step. But the success of this depends on 2 factors –

1) Seamless integration of all the bank’s platforms: a transaction carried out at a digital branch, not reflecting on the bank’s existing platforms could tamper the bank’s credibility.

2) An optimal mix of human and digital elements: the levels of literacy and tech-savviness cannot be uniform for all customers. Thus, human guidance is necessary. Without this guidance, cutting-edge technology could be viewed as an unnecessary annoyance.

Let’s take the case of Enpara.com, Turkey’s first purely digital bank. Aiming to cater to the likes of millennials, this company liaised with Veripark to build an omni-channel approach. The business model took advantage of the absence of brick-and-mortar costs and converted it to free services and loyalty rewards. The millennials loved the idea so much that 50% of Enpara.com’s customers are from referrals.

4. Once upon a time, there used to be queues…

With neobanks changing the scenario for onboarding, banks have no option but to catch the digital express. Digital onboarding could be one of those innovations that are so simple that the rest of the industry thinks, ‘Gosh, why didn’t I come up with that!’

As per Visa’s research, which summarizes the result of 70 different onboarding journeys, customers who onboard digitally are happier and are more likely to refer the bank to their circle. Moreover, they also transact more and utilize a wider range of financial services.

Brands have taken this a step further by delivering thoughtfully curated welcome gifts to clients, thus establishing a sense of brand loyalty. Jupiter, a neo-bank, and Basis, India’s first credit card service curated for women, make excellent case studies for this. The welcome kits are dispatched such that the customer receives the kit within a few days of signing up for the service.

These tweets applauding these gifts are testaments to how digital onboarding is effective when done right.

If it’s so great, why haven’t all firms in the financial domain signed up for it? Well, every progress comes with its own set of challenges. Improper migration to digital onboarding may invite negative comments. Add in higher rate of customer abandonment and frequent regulatory changes, we can see why decision makers are hesitant about the digital shift.

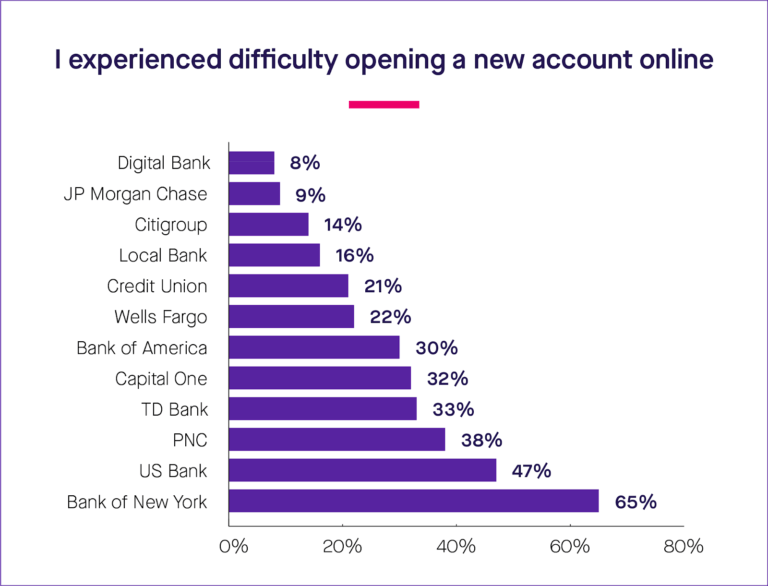

Here’s a chart to depict how improper migration could harm a bank’s business.

A report suggests that 32% of customers walk away from a brand after just one bad experience. Let’s see what Bank of America had to rectify about its digital onboarding process. While having made the onboarding process online, it left customers hanging when it came to the status of their application. One would have to regularly check the site for the application status or wait for an email conveying the status. With the major process being digital, the customer would expect to be notified upon the acceptance/rejection of the application. This hiccup in the onboarding flow may have disappointed customers with the need to log in more often than required.

5. That’s so ‘you’!

Marketing a product/service to everyone is worse than marketing to no one at all. An average user receives at least 40 notifications. So, when a person receives your offer as the 41st notification, it has to be attractive enough to grab their attention. Else, the effect is not just zero, but can be negative. The target is likely to be irritated by it too!

This is where hyper-personalization comes in. Standing out amidst a sea of offers doesn’t have to be complicated. Enterprises could analyze their client data and target the right audience with the right offers. With data analysis, firms could tap into the value lying latent in their first-hand data. Plug-and-play platforms like maya.ai can bring in additional third-party data as well, for a 360-degree customer view.

6. Less of ‘Press 1 for English’

While customer service centers definitely have the human touch, giving them an edge over IVR, waiting is not really a customer’s cup of tea. In 2022, chatbots and virtual assistants proved that they could save time on both sides.

And their capabilities go much beyond query-solving. They’re all set to be deployed to study an individual’s financial behavior over time and make suitable suggestions. For example, if one has a problem with regular payment or expenditure, and their account seems to be short of funds, the digital assistant could give them a nudge to maintain sufficient balance.

7. No/Low-code is the New Sexy

If innovation is hard, integration of such innovation is doubly so. When it comes to BFSI, most players prefer to keep the development internal, in the interest of data security. The downside to this is that most in-house tech teams take longer timelines to implement or integrate the innovation. Such delay could be a disadvantage if the innovation is pioneering in nature.

To combat this, banks are becoming increasingly open to the adoption of no-code/low-code platforms that could be integrated to their core application. This could be a turning point in bringing innovations faster to the market. According to a recent report, this global market for low-code/no-code platforms is likely to become a $65 billion market by 2027.

For instance, Banco Bradesco (Brazil’s second largest bank) chose a low-code, no-code platform to deliver multiple applications across the bank and improve its digitalization.

So…

It’s been three years since the pandemic forced the world to go digital first. So, there’s no excuse for BFSI firms to fight digital advancement. Going against the grain in this case is a recipe for disaster. Instead, it can ensure that the advancements are implemented in a proper fashion. That way, innovations become a win-win for both sides.

![Slaves to the Algo: AI podcast by Suresh Shankar [Season 1]](https://crayondata.ai/wp-content/uploads/2023/07/AI-podcast-by-Suresh-Shankar.jpg)

![Slaves to the Algo: an AI podcast by Suresh Shankar [Season 2]](https://crayondata.ai/wp-content/uploads/2023/08/version1uuid2953E42B-2037-40B3-B51F-4F2287986AA4modecompatiblenoloc0-1.jpeg)